In 2024, having a residence permit is very convenient for foreigners living in the Russian Federation. With this document, they can reside in Russia for any length of time, get hired for work without needing any additional permits, and receive benefits. Those who dream of a Russian citizenship will need to obtain a Russian permanent residency first (in most cases). In this article, we will lay bare the ins and outs of who can get a residence permit in Russia, how and on what grounds they can do so, and why a foreigner in Russia might need a resident’s status in the first place.

If an American expat receives permanent residency in Russia, this will allow them to stay in the country for a long time without any significant restrictions, and to enjoy all of the rights Russian nationals have: the right to work, to enroll one’s children into schools and kindergartens, and to change one’s place of residence within the country itself. Another important point to remember is that having residency status is the final step that needs to be taken before applying for a Russian passport.

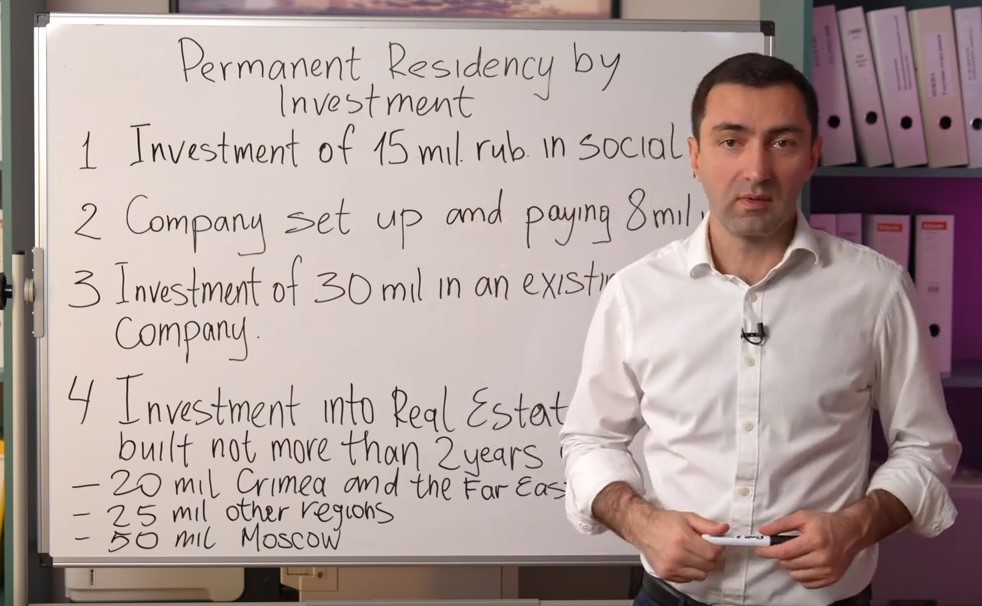

Obtaining Residency in Russia Through the Purchase of Real Estate

Foreigners can purchase real estate in Russia. Owning real estate can simplify the process of obtaining a residence permit by providing a place to live and fulfilling the requirement of being registered at a certain address. A new law that came into force in January 2023 allows foreigners to obtain a residency permit when buying real estate, including apartments, houses, and commercial properties. The law also allows relatives of the property owner to apply for a permanent residency permit.

If you wish to obtain permanent residency in Russia through the Golden Visa program by purchasing real estate, two crucial conditions must be met simultaneously:

- The age of the house or apartment must not exceed 2 years.

- The cadastral value of an apartment or house should be at least 25 million rubles if the property is located outside the city of Moscow. If the property is situated within the territory of Moscow, then in such a case, the cadastral value should be at least 50 million rubles. It is important to note that the cadastral value of real estate in Russia is typically 3-5 times lower than the market value.

Our company helps foreigners buy residential real estate in Russia. We also take it upon ourselves to resolve the problems our clients face in gaining the right to reside in Russia.

According to our data, foreign nationals most often buy properties located in Moscow and Moscow Oblast, St. Petersburg and Leningrad Oblast, and Sochi.

It is noteworthy that there are restrictions in place for foreigners wishing to buy land in certain regions. These restrictions apply to plots of land located in areas pertaining to borders, maritime ports and agricultural territories; forest land and nature reserves; and defense establishments. A foreign national will also not be able to purchase real estate in any of Russia’s closed cities.

Contents

Residency Requirements and Real Estate Deals

A real estate deal can be made between a Russian national and a foreigner in the same time frame as a deal between two Russian nationals would require. Once a foreigner buys real estate, they are not automatically issued a temporary residence permit.

Owning a property will make the procedure of obtaining a residency permit simpler, because another requirement of the residence permit application is being registered at a certain address. Thus, if you own real estate in Russia, you will be registering yourself at your own address, and will not need to find a willing landlord (i.e. “receiving party”).

Prolonging a Permanent Residence Permit

For a long time, Russian residence permits were issued for a period of five years. Those who had acquired such a permit could prolong it for a further five years when it expired. The number of such prolongations was unlimited. Now, newly issued residence permits are valid indefinitely, but if an expat is in possession of a 5-year permit, to avoid the need for prolongation they should exchange it for the new form of the permit.

How Can an American Expat in Russia Obtain a Residence Permit?

The list of documents required for a residence permit application for citizens of the USA and UK is as follows:

- Identity card (and/or passport);

- Full-face photos, without headwear;

- Medical certificates;

- Proof of income/employment;

- Accommodation papers;

- Receipt proving the payment of the application fee;

- Other documents, which may be requested by the inspector, such as: a tax declaration, a copy of the contract for the purchase and sale of real estate, etc.

Besides new rights, a residence permit comes with certain liabilities. During the term that a residence permit is valid, the American expat who has received it must: inform the authorities every time his/her actual place of stay or residence changes, avoid spending over six months outside the Russian Federation (otherwise, the residence permit may become void), and support him/herself and his/her family (does not apply to incapacitated persons).

The submitted documents and application are reviewed over a six-month period.

Reasons a Residency Application May Be Refused

Sometimes, foreign nationals are refused a residence permit. But in many such situations, something can be done about it. The main thing here is to correct the consequences of wrong actions within a set time frame.

The most common reason for a refusal is an error in the required documents. Some foreigners make mistakes when filling out the application form itself, or do not submit the full set of documents. In such a case, a refusal can be very upsetting, as all of one’s plans would fall apart due to just a small mistake or a common misunderstanding. And so, if you are not completely sure you will be able to avoid all the pitfalls and master all the nuances of the procedure for obtaining a residence permit, you should consider engaging a competent consultant’s services in advance.

In some other cases, the issue is that a foreign national does not possess all of the relevant information. For example, he/she does not fit the category of persons who can apply for a residence permit, but does not even know it. Meanwhile, the law of the Russian Federation clearly defines the categories of persons who are foreign nationals that will be refused a residence permit if they apply for one. This scenario results in a waste of time and the cancelation of all of one’s plans. Below is a list of circumstances that are legal grounds for a refusal:

- Deportation or expulsion from the country;

- Submission of false information, forging of documents;

- Outstanding criminal record, perpetration of crimes;

- Inability to support oneself or one’s family without government aid;

- Residence in another country for a period exceeding six months;

- Dangerous infections, drug addiction;

- Fictitious marriage.

There are also other official grounds for a permanent residence application refusal. It is worth remembering that it is not uncommon for the legislation to contain moot points that can only be resolved by a highly qualified lawyer. To avoid finding yourself in an awkward situation, it is always advisable to consult a lawyer to get an expert assessment of the likelihood of an approval before submitting your application for a Russian residence permit.

How to Apply for a Temporary Residence Permit in Russia?

In Russia, a temporary residence permit can be obtained within a quota or out of one.

Russia’s various regions distribute quotas taking into account the local need for qualified professionals in particular fields. If a foreign national’s education and proven experience interests the Federal Migration Service, he/she will get the chance to receive a quota approval. The number of quota approvals is limited, and they are distributed among applicants once per year.

Here is a list of cases when a temporary residence permit can be obtained by a foreign national without a quota approval:

- He/she has entered into a marriage with a citizen of Russia;

- He/she was born on the territory of Russia;

- He/she is an American citizen and is the legal guardian of a relative in Russia who is incapacitated;

- He/she is an American citizen and has a minor child who is a citizen of Russia.

To receive a temporary residence permit in Russia, an adult citizen of the US is required to submit the following set of documents:

- 2 filled out application forms;

- 4 photos (3 х 4 cm);

- A certificate proving the absence of a criminal record, issued in the US;

- A medical certificate proving the absence of drug addictions and a number of contagious diseases: HIV, certain venereal conditions and tuberculosis;

- A certificate proving fluency in the Russian language, and knowledge of Russian history and fundamental laws (not required for foreigners older than 65 years of age);

- A marriage certificate and the spouse’s Russian passport (for those who are applying for a temporary residence permit on the grounds of marriage).

These documents are submitted to the local office of the Migration Center. A fingerprinting procedure is undergone simultaneously, and the applicant’s fingerprints are entered into the nationwide database.

After this, the wait begins. The applicant can check whether their application has been reviewed and their permit is ready for collection on the official website of the Ministry of Internal Affairs of the Russian Federation.

How an American Expat Can Become a Citizen of Russia?

Each year, no less than 500 000 people receive a Russian citizenship.

The procedure for obtaining a citizenship of the Russian Federation for a national of the USA is considered to be somewhat complex if the American national does not have close relatives who are themselves Russian citizens and is not fluent in the Russian language. If this is the case, then, most likely, he/she will need to apply for a Russian passport on general grounds. This means that he/she would need to have resided in Russia for a period of at least five years. During this time, if he/she chooses to leave the country, the total time he/she spends outside of Russia must not exceed 3 months per year. Otherwise, he/she will lose his/her residency status, and will have to start his/her journey towards a Russian citizenship from the beginning. An exception to this rule is made for people who are known for their outstanding cultural, scientific or sports achievements. Such persons are allowed to only stay in the country for 1 year instead of 5 before receiving their Russian passport.

Attention! A Russian citizen can obtain citizenship of the US without losing their Russian citizenship. But a citizen of the US will need to renounce his/her US citizenship to receive a Russian passport.

To be able to apply for a Russian passport, and American national needs to:

- Learn the Russian language in Russia;

- Be of legal age (18+ years old);

- Have no criminal record;

- Be capable of earning an income that is not less than the minimum wage for the region where he/she is residing, and be able to provide evidence of his/her income level, for example, a 2-NDFL certificate;

- Correctly fill out and assemble the required documents.

How to Get a Russian Passport?

If the required documents for an application for Russian citizenship are being assembled by an immigration lawyer on behalf of a citizen of the US, then a Russian passport can be obtained in just the following 7 steps:

- Getting a visa in the office of a permanent mission, consulate or embassy of the Russian Federation;

- Crossing the border into Russia;

- Obtaining a migration card within a week of arriving in Russia;

- Obtaining a quota approval, unless one has grounds for being granted residency or a Russian citizenship via a simplified procedure;

- Acquiring a temporary residence permit with a 3-year validity term;

- Acquiring a permanent residence permit with a 5-year validity term and confirming one’s status as a resident yearly by submitting a proof of income certificate and a document from one’s place of permanent residence to the Federal Migration Service;

- Applying for the passport of a citizen of the Russian Federation.

For each step, a number of documents need to be collected, filled out and properly assembled. Our lawyer can handle this task for you, filling out all of the necessary forms. He will assemble each set of documents in such a way that it will be approved by the Federal Migration Service’s inspectors on the first try.

How Does One’s Residency Status Affect the Need to Pay Taxes in Russia?

The status of a “tax resident” is granted to persons who are registered as residents and are in fact residing on the territory of the Russian Federation, while complying with all of the applicable legal requirements.

Here is a list of persons who, according to Russia’s law, have tax residency status in the country:

- Citizens of Russia (i.e., those in possession of a civil passport), unless they have been residing abroad for over 365 days;

- Citizens of Russia who have received a permanent residence permit in another country;

- Citizens of Russia who are staying in another country on the grounds of a study or work visa;

- Foreigners who have received a Russian residence permit;

- Officially registered legal entities;

- Employees of consulates and diplomatic institutions located in other countries;

- Municipal bodies and their constituent entities.

Non-residents are those individuals/legal entities who have no permanent place of residence (i.e. are not permanent residents) in Russia. Persons who stay in the country for less than 183 days in the duration of 1 year are considered to be non-residents.

Individuals and legal entities who are recognized as tax residents enjoy a tax rate of 13% and 20% respectively. Non-residents pay their tax at the rate of 30%. For some categories of non-resident individuals, the tax rate may be reduced:

- Persons having the status of a refugee, immigrant or highly qualified specialist, as well as those who are crew members of sea vessels or workers employed on the grounds of a patent, pay their personal income tax at the rate of 13%;

- Persons who have invested their funds in Russia pay 15% on income received in the course of carrying out their investment activities.

The main differences between the resident and non-resident taxpayer status are the following:

- Different tax rates;

- Different lists of objects subject to taxation;

- Different procedure for determining the tax base;

- Different tax deduction and calculation options.

The status of a resident in Russia carries with it the liability to declare, and therefore pay tax on all types of income received, while a non-resident taxpayer only pays tax on income they have received within the country itself.